Independent Contractor Agreement and Service Agreement: nuances concluding with a non-resident

On June 28, 2023, Znak Nadezhda, lawyer and partner of Borovtsov & Salei, spoke at the online seminar “Independent Contractor Agreement and Service Agreement: How to Draw Up Correctly and Safely”.

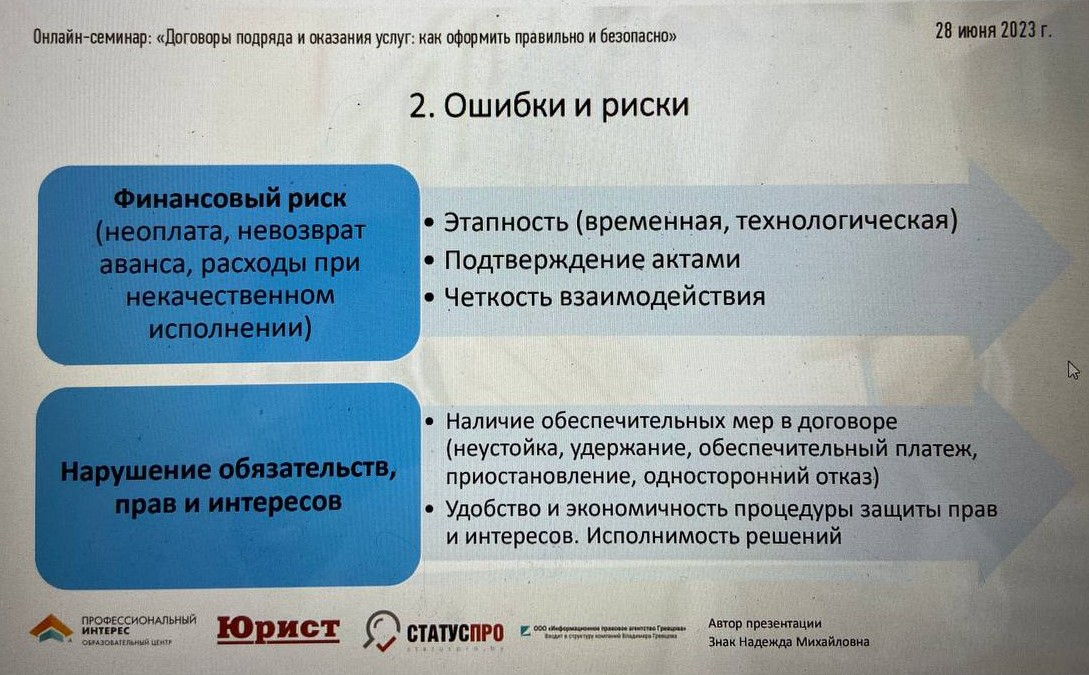

The report reflects the features of concluding an agreement with a non-resident, the mandatory conditions that a foreign hard currency agreement must comply with, identifies the main risks that a resident may face when executing a contract with a non-resident, and suggests ways to minimize risks.

The presentation cites cases when Independent Contractor Agreement and Service Agreement concluded with a non-resident may result in additional tax liabilities for the resident: establishment of a permanent establishment, payment of tax on income of foreign organizations.

Thank you for organizing the event Magazine “Lawyer” and Educational Center “Professional Interest”.